Taxes

Assessment

•

Next Gen Personal Finance

•

Life Skills

•

9th - 12th Grade

•

15K plays

•

Medium

Improve your activity

Higher order questions

Match

•

Reorder

•

Categorization

.svg)

actions

Add similar questions

Add answer explanations

Translate quiz

Tag questions with standards

More options

20 questions

Show answers

1.

Multiple Choice

Who primarily uses our tax money?

Your employer

Large corporations

Federal and state government

Local Businesses

2.

Multiple Choice

Our tax money is spent on all of the following EXCEPT:

Social Security

The Military

Private School Education

National Parks

3.

Multiple Choice

Which of the following is NOT a category in the Federal government's spending?

Mandatory spending

Discretionary spending

Interest on loans issued

Interest on national debt

4.

Multiple Choice

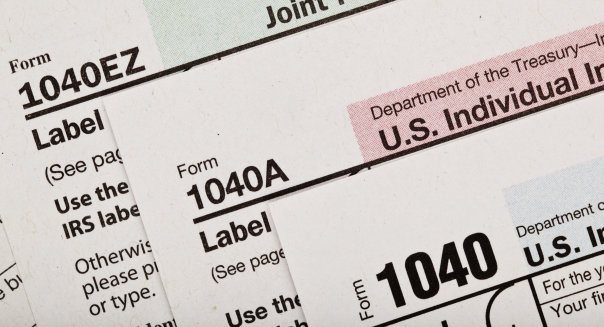

Which of the following taxes is applied to wages, salaries, dividends, and interest earned?

Corporate Income Tax

Income Tax

Estate Tax

Excise Tax

5.

Multiple Choice

The W-4 form lets...

the government know how much you paid in taxes last year

your employer know how much to withhold from your paycheck

the 3 major credit bureaus know how many dependents you have

you know how much you paid in taxes last year

6.

Multiple Choice

Jess is 21, in college, & has a job that provides 65% of her support. Is she a dependent?

Yes

No

Explore this activity with a free account

Find a similar activity

Create activity tailored to your needs using

.svg)

Career

•

9th - 12th Grade

Health Care Insurance

•

10th Grade

Employability Vocabulary

•

9th - 12th Grade

Insurance

•

10th - 12th Grade

Job Application Vocabulary Sentences

•

10th - 12th Grade

Career Terminology

•

6th - 8th Grade

Federal Income Taxes

•

11th - 12th Grade

Internet Safety

•

1st - 5th Grade